The commercial banking system is the core of India’s financial system as the financial sector of the country is bank dominated. Though cooperative banks also play a critical role in facilitating banking services in the country, the scheduled commercial banks are overwhelmingly important in terms of their asset size, branch networks, type of services delivering etc. The ccommercial banking sector comprises of public sector banks (State Bank of India and Nationalised Banks), private sector banks (old and new), foreign banks, Small Finance Banks and Payment Banks.

The commercial banking sector was evolved into the present status and structure after undergoing a big and extended evolution phase. Nationalisation of banks in two phases (1969 and 1980), entry of new generation banks and the reverse merger of Development Financial Institutions (like ICCI, IDBI etc.), creation of differentiated banks under Small Finance Banks and Payment Banks, recent consolidation of PSBs etc. conditioned the current banking structure in India. The merger of HDFC Bank Ltd and Housing Development Finance Corp, created a titanic shift in the Indian financial sector with the HDFC bank becoming a financial behemoth.

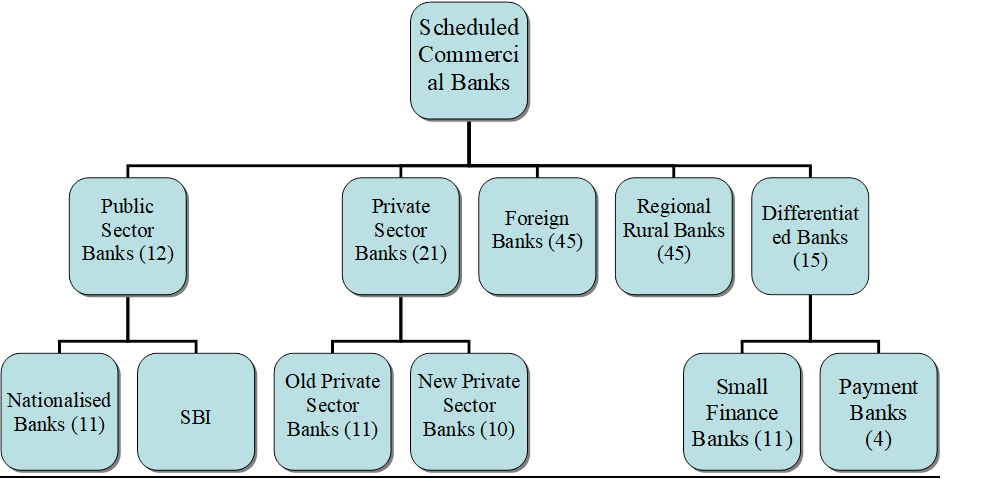

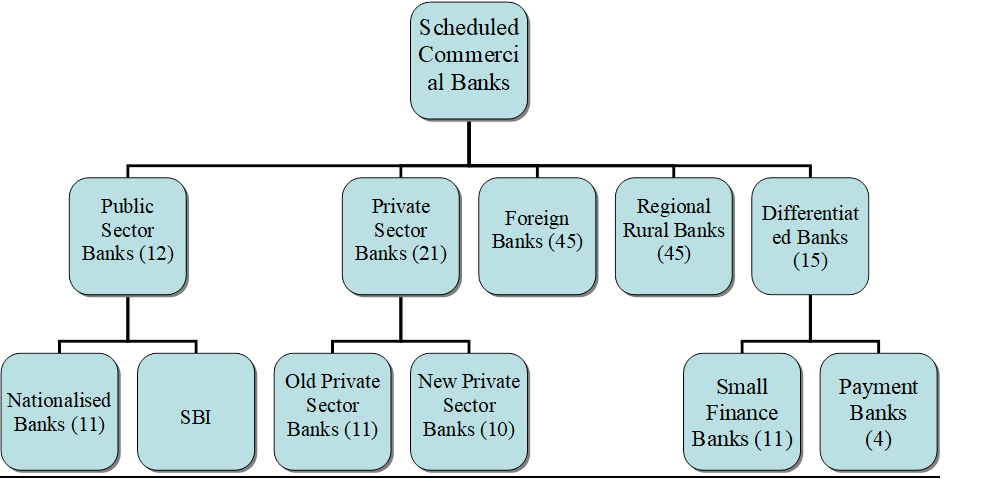

Figure: Structure of Commerical Banks in India

Uniqueness of scheduled commercial banks

Commercial banks in India are classified by the RBI into scheduled and non-scheduled banks from the angle of regulation. Bulk of the banks are scheduled whereas some banks like Local Area Banks re non-scheduled. As scheduled banks, the scheduled commercial banks come under exceptional regulatory and supervisory standards of the RBI. At the same time, they get the advantage of availing special facilities from the RBI like Liquidity Adjustment Facility, Deposit Insurance, Lender of Last Resort etc.

| Asset share of SCBs in India (2022) | ||

| Category | In Rs crores | % Share |

| PSBs | 12706661 | 59% |

| Private Banks | 7371715 | 34% |

| Foreign Banks | 1368521 | 6% |

| SFBs | 203076.2 | 1% |

| PBs | 17681.3 | 0% |

| Total | 21667655 | 100% |

| Source: RBI DBIE | ||

Structure of scheduled commercial banks in India

The commercial banking sector is dominated by Public Sector Banks (PSBs) and as of March 31 st , 2022, the PSBs have nearly 60% market share in terms of assets, followed by private sector. Still, their asset share has been declining over the last two decades. The asset share (share in banking sector loans and investments) is the best indicator to measure the size and importance of each banking entity.

Table: Market Capitalistion of Scheduled Commercial Banks Post Merger of HDFC Bank Ltd and Housing Development Finance Corp.

| Rank | Bank | Market capitalisation( ₹crore) |

| 1. | HDFC Bank (post merger) | 14,12,055.5 |

| 2. | ICICI Bank Ltd | 6,53,704.04 |

| 3. | State Bank of India | 5,11,201.77 |

| 4. | Kotak Mahindra Bank Ltd | 3,66,967.55 |

| 5. | Axis Bank Ltd | 304211.88 |

| 6. | Indusind Bank Ltd | 106707.03 |

| 7. | Bank of Baroda | 98436.88 |

| 8. | IDBI Bank Ltd | 59482.29 |

| 9 | Punjab National Bank | 56882.91 |

| 10. | Canara Bank | 54750.45 |

The scheduled commercial banks in India are classified under different categories: Public Sector Banks (PSBs), private sector banks, foreign banks, regional rural banks (RRBs), foreign banks, small finance banks and payment banks. As of March 2023, there are:

(1) Public Sector Banks (PSBs): Public Sector banks are owned by the government. They have the largest share in India’s commercial banking system. PSBs consists of Nationalised Banks and the SBI. The SBI is the largest bank in India, while the Punjab National Bank is the second-largest among PSBs. In recent years, the government merged several nationalised banks. Now there are only 12 public sector banks.

(2) Private sector Banks (PVBs): The private sector banks are old private sector banks and new private sector banks. These banks are performing well in terms of profit and health. Their NPAs are low compared to that of the PSBs. The private sector banks, including HDFC and ICICI etc, are very competitive and are providing a large variety of products.

(3) Foreign Banks: There are only 45 foreign banks in India. The foreign banks are operating in branch mode and subsidiary mode.

| Old Private Sector Banks | New Private Sector Banks |

| CITY UNION BANK LIMITED | AXIS BANK LIMITED |

| CSB BANK LIMITED | BANDHAN BANK LIMITED |

| FEDERAL BANK LTD | HDFC BANK LTD. |

| JAMMU & KASHMIR BANK LTD | ICICI BANK LIMITED |

| KARNATAKA BANK LTD | IDBI BANK LIMITED |

| KARUR VYSYA BANK LTD | IDFC FIRST BANK LIMITED |

| NAINITAL BANK LTD | INDUSIND BANK LTD |

| SOUTH INDIAN BANK LTD | KOTAK MAHINDRA BANK LTD. |

| TAMILNAD MERCANTILE BANK LTD | YES BANK LTD. |

| THE DHANALAKSHMI BANK LTD | DCB Bank |

| RBL Bank |

(4) Small Finance Banks: Small finance banks are private sector banks that offer limited products to the customers. They are formed in 2016 after the RBI’s differentiated bank licensing policy to further financial inclusion through tailored deposit products and for providing credit to small business units, small and marginal farmers, micro and small industries and other unorganized sector entities through technology led low-cost operations. At end-March 2022, twelve SFBs with 5,677 domestic branches across the country. Most of the small finance banks operate in semi-urban areas. The SFBs achieved a priority sector lending rate of 85% as of March end 2022.

(5) Payment Banks: These are licensed by the RBI to perform payment services and has only limited banking functions. PBs were set up as niche entities to facilitate small savings and to provide payments and remittance services to migrant labour, low-income households, small businesses and other unorganised sector entities. At end-March 2022, 4 PBs were operational, of which only three managed to become profitable in their operations. The Indian Postal Payment Bank (IPPB) is the first scheduled payment bank. Income from remittance operations formed a major part of income of PBs.

(6) Regional Rural Banks: RRBs are promoted by the central government, state government and the sponsoring scheduled commercial bank. The RRBs gives loans to small and marginal farmers and other priority sectors. Their number is shrinking as the RBI, and the government are trying for their consolidation.

Besides these, there are Local Area Banks (LABs) as well. But they are non-scheduled banks and doesn’t have much limelight because of their declining size. Local Area Banks (LABs) are small private banks designed as low-cost banks to promote efficient and competitive financial intermediation services in a limited area. They are concentrated primarily in rural and semi-urban areas. There are only four LABs in India.

Table: Ranking of Scheduled Commercial Banks in terms of asset share (before the merger of HDFC on July 1st, 2023

| Bank | Total Assets | As a % of total assets | Type of Bank |

| STATE BANK OF INDIA | 4987597.41 | 23.02 | PSB |

| HDFC BANK LTD. | 2068535.05 | 9.55 | PvB |

| ICICI BANK LIMITED | 1411297.74 | 6.51 | PvB |

| PUNJAB NATIONAL BANK | 1314805.02 | 6.07 | PSB |

| BANK OF BARODA | 1277999.83 | 5.90 | PSB |

| CANARA BANK | 1226979.67 | 5.66 | PSB |

| UNION BANK OF INDIA | 1187591.06 | 5.48 | PSB |

| AXIS BANK LIMITED | 1175178.11 | 5.42 | PvB |

| BANK OF INDIA | 734614.01 | 3.39 | PSB |

| INDIAN BANK | 671668.06 | 3.10 | PSB |

| KOTAK MAHINDRA BANK LTD. | 429428.40 | 1.98 | PvB |

| INDUSIND BANK LTD | 401974.58 | 1.86 | PvB |

| CENTRAL BANK OF INDIA | 386565.59 | 1.78 | PSB |

| YES BANK LTD. | 318220.23 | 1.47 | PvB |

| IDBI BANK LIMITED | 301419.36 | 1.39 | PvB |

| INDIAN OVERSEAS BANK | 299377.17 | 1.38 | PSB |

| UCO BANK | 267784.02 | 1.24 | PSB |

| HONGKONG AND SHANGHAI BANKING CORPN.LTD. | 247310.08 | 1.14 | FB |

| CITIBANK N.A | 233264.53 | 1.08 | FB |

| BANK OF MAHARASHTRA | 230611.37 | 1.06 | PSB |

| FEDERAL BANK LTD | 220946.31 | 1.02 | PvB |

| IDFC FIRST BANK LIMITED | 190181.61 | 0.88 | PvB |

| STANDARD CHARTERED BANK | 175938.12 | 0.81 | FB |

| DEUTSCHE BANK AG | 147954.86 | 0.68 | FB |

| BANDHAN BANK LIMITED | 138866.55 | 0.64 | PvB |

| JAMMU & KASHMIR BANK LTD | 130602.41 | 0.60 | PvB |

| PUNJAB AND SIND BANK | 121067.55 | 0.56 | PSB |

| RBL BANK LIMITED | 106208.58 | 0.49 | PvB |

| SOUTH INDIAN BANK LTD | 100052.42 | 0.46 | PvB |

| KARNATAKA BANK LTD | 92040.55 | 0.42 | PvB |

| JPMORGAN CHASE BANK NATIONAL ASSOCIATION | 90873.76 | 0.42 | FB |

| DBS BANK INDIA LTD. | 84361.61 | 0.39 | FB |

| KARUR VYSYA BANK LTD | 80043.72 | 0.37 | PvB |

| AU SMALL FINANCE BANK LIMITED | 69077.80 | 0.32 | SFB |

| BANK OF AMERICA , NATIONAL ASSOCIATION | 62332.83 | 0.29 | FB |

| CITY UNION BANK LIMITED | 61530.91 | 0.28 | PvB |

| BNP PARIBAS | 58674.53 | 0.27 | FB |

| TAMILNAD MERCANTILE BANK LTD | 52858.49 | 0.24 | PvB |

| DCB BANK LIMITED | 44840.14 | 0.21 | PvB |

| BARCLAYS BANK PLC | 40146.09 | 0.19 | FB |

| MUFG BANK LTD | 34703.77 | 0.16 | FB |

| EQUITAS SMALL FINANCE BANK LIMITED | 26951.90 | 0.12 | SFB |

| SUMITOMO MITSUI BANKING CORPORATION | 26556.61 | 0.12 | FB |

| CSB BANK LIMITED | 25356.27 | 0.12 | PvB |

| UJJIVAN SMALL FINANCE BANK LIMITED | 23604.46 | 0.11 | SFB |

| CREDIT SUISSE AG | 20732.07 | 0.10 | FB |

| MIZUHO BANK LTD | 20492.69 | 0.09 | FB |

| JANA SMALL FINANCE BANK LIMITED | 20188.71 | 0.09 | SFB |

| ESAF SMALL FINANCE BANK LIMITED | 17707.56 | 0.08 | SFB |

| CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK | 16652.57 | 0.08 | FB |

| UTKARSH SMALL FINANCE BANK LIMITED | 15063.77 | 0.07 | SFB |

| THE DHANALAKSHMI BANK LTD | 13795.76 | 0.06 | PvB |

| SHINHAN BANK | 13315.71 | 0.06 | FB |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | 12520.27 | 0.06 | FB |

| FINCARE SMALL FINANCE BANK LIMITED | 10905.90 | 0.05 | SFB |

| FIRST ABU DHABI BANK PJSC | 10297.42 | 0.05 | FB |

| PAYTM PAYMENTS BANK LIMITED | 9359.77 | 0.04 | PB |

| SOCIETE GENERALE | 9097.65 | 0.04 | FB |

| AMERICAN EXPRESS BANKING CORP. | 8677.60 | 0.04 | FB |

| NAINITAL BANK LTD | 8337.86 | 0.04 | PvB |

| SURYODAY SMALL FINANCE BANK LIMITED | 8180.18 | 0.04 | SFB |

| SBM BANK (INDIA) LTD. | 8084.62 | 0.04 | FB |

| CAPITAL SMALL FINANCE BANK LIMITED | 7153.92 | 0.03 | SFB |

| BANK OF NOVA SCOTIA | 5135.34 | 0.02 | FB |

| NATWEST MARKETS PLC | 4760.45 | 0.02 | FB |

| WOORI BANK | 4653.33 | 0.02 | FB |

| EMIRATES NBD BANK (P.J.S.C.) | 4581.87 | 0.02 | FB |

| INDIA POST PAYMENTS BANK LIMITED | 4501.11 | 0.02 | PB |

| INDUSTRIAL AND COMMERCIAL BANK OF CHINA | 3817.59 | 0.02 | FB |

| COOPERATIEVE RABOBANK U.A. | 3774.70 | 0.02 | FB |

| CTBC BANK CO., LTD. | 2666.52 | 0.01 | FB |

| BANK OF BAHRAIN & KUWAIT B.S.C. | 2592.42 | 0.01 | FB |

| KEB HANA BANK | 2531.65 | 0.01 | FB |

| NORTH EAST SMALL FINANCE BANK LIMITED | 2352.00 | 0.01 | SFB |

| AIRTEL PAYMENTS BANK LIMITED | 2140.42 | 0.01 | PB |

| SHIVALIK SMALL FINANCE BANK LIMITED | 1890.02 | 0.01 | SFB |

| KOOKMIN BANK | 1856.66 | 0.01 | FB |

| FINO PAYMENTS BANK LIMITED | 1680.00 | 0.01 | PB |

| QATAR NATIONAL BANK (Q.P.S.C.) | 1546.41 | 0.01 | FB |

| UNITED OVERSEAS BANK LTD | 1407.96 | 0.01 | FB |

| MASHREQ BANK PSC | 1394.58 | 0.01 | FB |

| DOHA BANK Q.P.S.C | 1281.99 | 0.01 | FB |

| SBERBANK | 942.88 | 0.00 | FB |

| INDUSTRIAL BANK OF KOREA | 825.22 | 0.00 | FB |

| BANK OF CEYLON | 564.83 | 0.00 | FB |

| BANK OF CHINA LIMITED | 410.48 | 0.00 | FB |

| FIRSTRAND BANK LTD | 352.74 | 0.00 | FB |

| AB BANK LIMITED | 343.46 | 0.00 | FB |

| JSC VTB BANK | 300.46 | 0.00 | FB |

| ABU DHABI COMMERCIAL BANK PJSC | 296.67 | 0.00 | FB |

| PT BANK MAYBANK INDONESIA TBK | 267.65 | 0.00 | FB |

| SONALI BANK | 164.33 | 0.00 | FB |

| KRUNG THAI BANK PUBLIC COMPANY LIMITED | 63.86 | 0.00 | FB |

| PSB-Public Sector Bank, PB-Private Sector Bank, FB-Foreign Bank, SFB, Small Finance Bank, PB-Payment Bank | |||

Source: RBI Data Base on Indian Economy